The economic and social developments of Curaçao 2023-2024

The economic and social developments of Curaçao in recent years have been marked by recovery and transition. After a period of severe shocks caused by the COVID-19 pandemic and international price increases, the most recent figures from the Central Bureau of Statistics (CBS) show moderate growth, declining inflation, and an improving labor market.

At the same time, structural challenges remain visible, such as income inequality, poverty, and the growing ageing of the population. Statistics form the foundation for policy and decision-making. They not only provide insight into the current situation but also help identify trends that will shape the country’s future.

This publication brings together the key figures on population, labor market, income development, poverty, inflation, and economic growth in 2024, and compares these—where possible—with previous years.

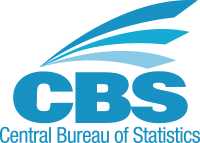

As of January 1st, 2025, Curaçao had 156,115 inhabitants. The population shows clear signs of aging: no less than 33.8% are 60 years or older, amounting to 52,805 people. This means that one in three residents now belongs to the older population. At the same time, the share of young people (0–14 years) is declining. As a result, the base of the population pyramid is shrinking while the top is widening.

This indicates a structural demographic shift in which fewer working-age individuals are available per older person. Within the older population, the group aged 60–64 years (often newly retired) is the largest category. As age increases, the share of women becomes higher, which is linked to their longer life expectancy.

The growing aging of the population has significant implications for Curaçaoan society. Pressure on healthcare, pensions, housing, and social services will increase, making timely policy measures essential to guide the island’s future development.

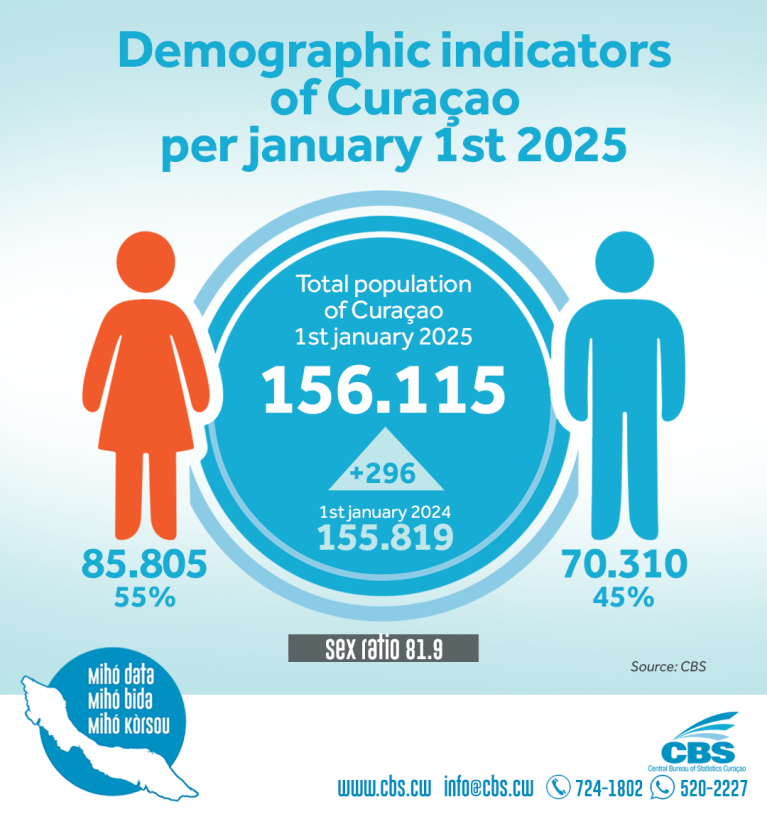

Between 2022 and 2024, Curaçao’s labor market showed a clear improvement. The employed population increased from 66.7 thousand to 71.9 thousand people (+7.8%). At the same time, the number of jobseekers fell from 10,000 to 6,100 (–39.3%). The unemployment rate, now at 7.8%, has dropped sharply compared with the 13.1% measured in the 2022 Labor Force Survey (LFS).

The decline in unemployment is occurring amid the ongoing recovery of Curaçao’s tourism sector. After a period of high unemployment—caused by numerous bankruptcies and business closures and further intensified by the COVID-19 pandemic—more people are now finding work as tourism fuels growth in sectors such as real estate, construction, and hospitality, according to the Central Bank of Curaçao and Sint Maarten (CBCS).

However, further research is needed to map out the increase in employment by sector. Tourism has grown significantly since then and has surpassed several pre-COVID levels. The total number of tourist arrivals has increased by at least 20% per year for the third consecutive year in 2024 (CTB).

This recovery not only highlights the crucial role of tourism in the island’s economic rebound but also shows the sector’s capacity to stimulate employment as it continues to expand.

Key Labor Market Indicators

• Employed population

Increased from 66,700 to 71,900, a rise of 5,200 people (+7.8%).

• Unemployed population

Dropped sharply from 10,000 in 2022 to 6,100 in 2024 (–39.3%).

• Unemployment rate

Declined from 13.1% in 2022 to 7.8% in 2024 (a decrease of more than 5 percentage points, or –40%).

The youth unemployment rate (young people aged 15–24) fell from 29.8% to 16.3%, a reduction of 45.3%.

The labor force grew by only 10 people. The number of employed youths increased by 930, while the number of unemployed youths decreased by 919. The economically inactive group decreased by 329 people.

Both the gross and net participation rates increased. The gross rate rose by 2.7% to 46.0%, and the net rate increased by 22.2% to 38.5%.

Conclusion

Since the peak during the COVID-19 pandemic, Curaçao has seen a decline in the unemployment rate—from 13.1% in the Labor Force Survey (LFS) 2022 to 7.8% in the LFS 2024 results. This drop can be attributed to the recovery of the tourism sector, which has created more employment across multiple industries on the island. Unemployment has fallen for both men and women, indicating a positive trend in the labor market for both genders.

Youth unemployment continued its downward trend, reaching a low level of 16.3%, compared to 29.8% in the 2022 LFS. This suggests that the labor market is providing more opportunities for young people than before. In addition to youth, all age groups between 25 and 64 saw decreases in their unemployment rates. This improvement reflects a labor market that is developing positively and offering more opportunities for the working population as a whole.

Notably, the only group for whom the unemployment rate increased compared to the previous LFS (2022) is those aged 65 and older. This may point to a shift in the labor market, with possibly less demand for older workers and more for younger workers who can remain active for longer. At the same time, the rise in both the labor force and the employed population in this age group suggests that these older individuals are either optimistic and willing to continue working, or that they do so out of necessity.

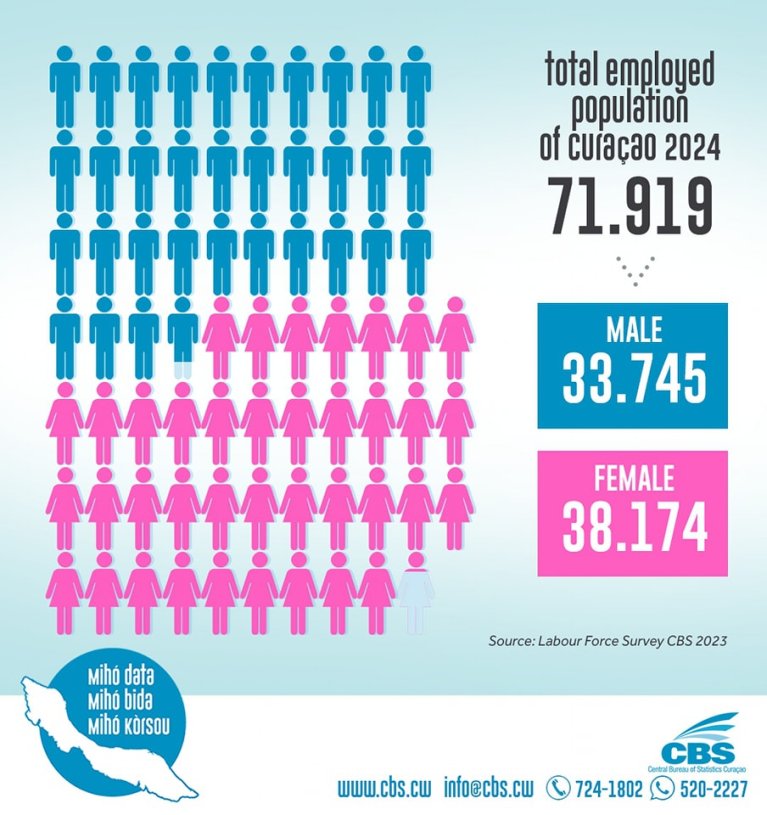

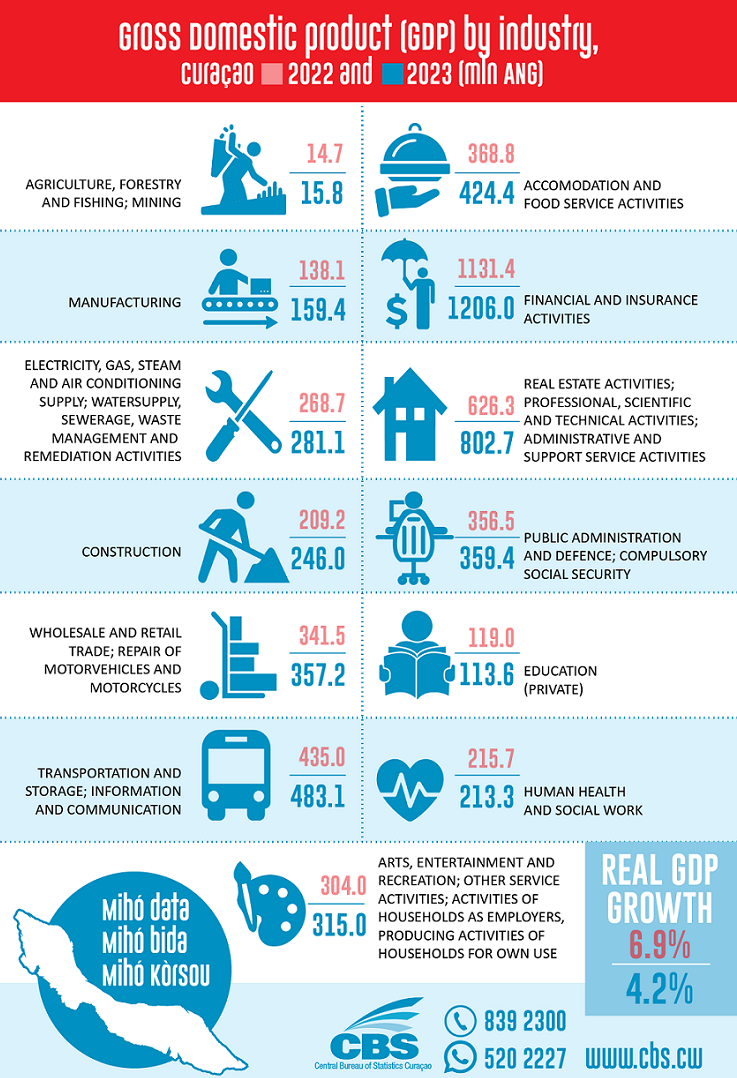

In 2020, the economy experienced a severe contraction, hitting a low point of more than –18 percent. This decline was the result of the global economic downturn caused by the pandemic, which affected economies worldwide.

In the years that followed, the economy began to recover, posting substantial positive growth figures. The strongest growth occurred in 2022, with 6.9 percent, indicating significant economic recovery and stabilization.

The strong improvement in 2021 and 2022 reflects effective economic measures and resilience, with growth figures rebounding considerably. The positive trend continued in 2023, suggesting ongoing economic stability and expansion. For 2024, further growth of 5.0 percent is projected.

Curaçao’s economy showed broad-based growth in 2024, with multiple sectors contributing positively. The Agriculture, Fisheries & Mining sector recovered after a contraction in 2023 and grew by 2.1%, mainly due to improved harvests and mining activities. The Industrial sector strengthened its growth from 6.5% to 7.0%, driven by export demand and spin-off effects from tourism. The Utilities sector also recorded higher growth (from 4.3% to 6.6%), supported by increased production of electricity and water, indicating rising demand from housing construction and commercial projects.

The Construction sector stood out with strong growth of 10.4%, fueled by major building and infrastructure projects. The Trade sector, after solid growth in 2023 (6.5%), saw a slightly more moderate increase of 5.6% in 2024, driven by higher imports and trade activities.

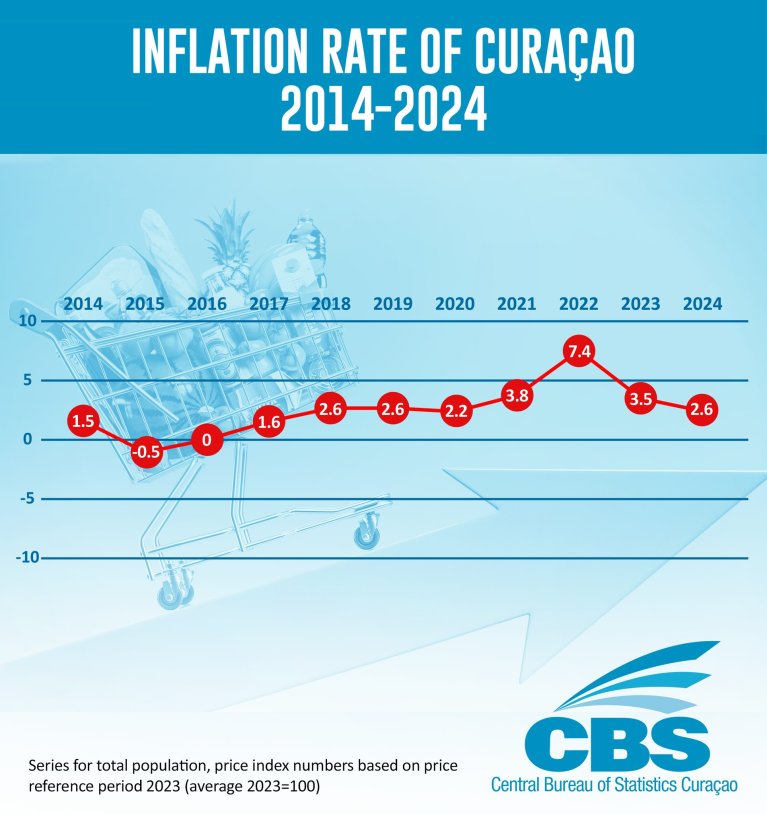

Headline inflation averaged 3.5% in 2023 and declined further to 2.6% in 2024. This indicates that overall price increases continued to ease.

Within the spending categories, some components still showed increases. Food remained a key driver of inflation, although the growth was weaker than in 2023. Vegetables, fruit, and dairy products contributed most to this rise. Housing also added upward pressure on prices, mainly due to energy expenses such as electricity and water, though its contribution in 2024 was lower than a year earlier. Alcoholic beverages and tobacco showed a slight increase as well, driven primarily by higher tobacco prices.

Other categories showed a clear slowdown or even declines. Clothing and footwear, which were slightly positive in 2023, were flat or slightly negative in 2024. Energy, which had been a major contributor due to sharp price increases in 2023, became far less influential and even showed occasional price drops. Transport also contributed less, partly due to more stable fuel prices.

In summary, food and housing remained the main pillars of inflation, but their impact clearly weakened. Energy prices cooled after the 2022–2023 peak, and goods such as clothing and transport contributed minimally or even negatively. Altogether, this indicates that Curaçao entered a phase of lower and more stable inflation in 2024.

Personal Income

The average gross personal monthly income amounted to ANG 3,218 in 2023, compared to ANG 3,023 in 2011, an increase of 6.5%. The median personal income showed a much stronger rise: from ANG 1,836 in 2011 to ANG 2,288 in 2023, an increase of 24.6%.

This development indicates that lower- and middle-income groups made the most progress, while the highest incomes grew less rapidly. As a result, the median income provides a more accurate picture of the improved income position of a large share of the population than the average.

Household Income

The average gross household income reached ANG 7,991 in 2023, compared to ANG 5,331 in 2011—an increase of 49.9%. The median household income rose from ANG 3,500 to ANG 5,177 over the same period, a growth of 47.9%.

Household incomes therefore increased at a much faster rate than personal incomes. This is mainly because more households now include multiple income earners—for example, two working adults or a combination of employment and pension income. However, the median household income remains clearly lower than the average, indicating that a relatively small group of high-income households pushes the average upward.

Conclusion

In summary, income development in Curaçao between 2011 and 2023 was positive, especially for households and middle-income groups. However, the gap between the average and the median shows that income inequality persists, with high incomes exerting a disproportionate effect on the averages.

Personal Income

The average gross personal monthly income amounted to ANG 3,218 in 2023, compared to ANG 3,023 in 2011, an increase of 6.5%. The median personal income showed a much stronger rise: from ANG 1,836 in 2011 to ANG 2,288 in 2023, an increase of 24.6%.

This development indicates that lower- and middle-income groups made the most progress, while the highest incomes grew less rapidly. As a result, the median income provides a more accurate picture of the improved income position of a large share of the population than the average.

Household Income

The average gross household income reached ANG 7,991 in 2023, compared to ANG 5,331 in 2011—an increase of 49.9%. The median household income rose from ANG 3,500 to ANG 5,177 over the same period, a growth of 47.9%.

Household incomes therefore increased at a much faster rate than personal incomes. This is mainly because more households now include multiple income earners—for example, two working adults or a combination of employment and pension income. However, the median household income remains clearly lower than the average, indicating that a relatively small group of high-income households pushes the average upward.

Conclusion

In summary, income development in Curaçao between 2011 and 2023 was positive, especially for households and middle-income groups. However, the gap between the average and the median shows that income inequality persists, with high incomes exerting a disproportionate effect on the averages.

Poverty Indicators (Census 2023)

- Headcount Index (poverty rate): 30.4% of households live below the poverty line.

- Poverty Gap Index: 11.0% → poor households fall on average 11% below the poverty threshold.

- FGT2 Index: 5.6% → the severity of poverty has increased, particularly among the poorest households.

Poverty Line

- The monetary poverty line as of 1 January 2024 is ANG 3,252 net per month for a household of two adults and two children.

- Standardized for household size (OECD equivalence scale): approximately ANG 1,549 per equivalent person.

Household Types

- 1 adult + 2 children: 41.0% below the poverty line (highest risk).

- Single adults: 39.4% below the poverty line.

- 2 adults + 2 children: 20.0% below the poverty line (lowest risk).

Geographical Differences

- Highest poverty rates: Scharloo (57.1%), Fortuna (53.2%), Paradijs (53.2%), Koraal Specht (51.2%).

- Lowest poverty rates: Zeelandia (2.5%), Mahaai (3.8%), Spaanse Water (4.6%).